CHICAGO — Bally’s Casino has scrapped its investment offering targeted at women and other minorities after facing significant legal challenges and a lack of guidance on the program from the Securities and Exchange Commission.

The company announced this week that it has submitted a new investment offering to the SEC that instead gives preference to Chicago and Illinois residents.

Bally’s won Chicago’s casino bid in 2022 after then-Mayor Lori Lightfoot selected the company over several competitors. Bally’s proposal included the highest projected annual payout for the city: nearly $200 million, along with a $40 million upfront payment and $4 million in annual payments.

As part of that deal, Bally’s is required to offer women and people of color a collective 25 percent equity stake in the $1.7 billion casino, which is under construction in River West. In January, Bally’s announced details of the investment offer. The minority investment stake let individuals invest anywhere from $250 to $25,000 per share in Bally’s Chicago casino.

But the deal stalled after two white men from Texas sued the city and Bally’s, arguing the investment offering was illegal because it prioritized applicants based on race.

The investment offer was created as an accessible opportunity for underrepresented groups to build “generational wealth,” Chicago officials previously said. However, Loop Capital, the offer’s underwriter, stated publicly that it would not verify the sex or race of applicants.

Now, Bally’s has submitted a new investment offering to the SEC that drops the requirement set by the community host agreement, a legally binding agreement between the city and Bally’s mandating a minority investment offering.

Bally’s did not answer questions about the deal, but Bally’s Chairman Soo Kim told The Real Deal the company was dropping the minority investment portion “because it’s not working.”

“With these hard and fast rules, nobody will get any equity,” Kim told The Real Deal.

In the original investment offering filed with the SEC, Bally’s outlined potential issues with the minority investment offer, saying it “may result in lawsuits against us and the City of Chicago by persons that do not meet” the minority requirement.

“If any person were to bring such a lawsuit against us, we could incur substantial costs defending the lawsuit, and the time and attention of our management would be diverted from our business and operations,” Bally’s team wrote in the offering. “Furthermore, in the event that a court were to find the Class A Qualification Criteria to be invalid or unconstitutional, the Host Community Agreement could be terminated, which could adversely affect our ability to operate our casinos and could materially adversely affect our business, financial condition, and results of operations.”

The Mayor’s Office did not respond to questions surrounding the updated investment offering.

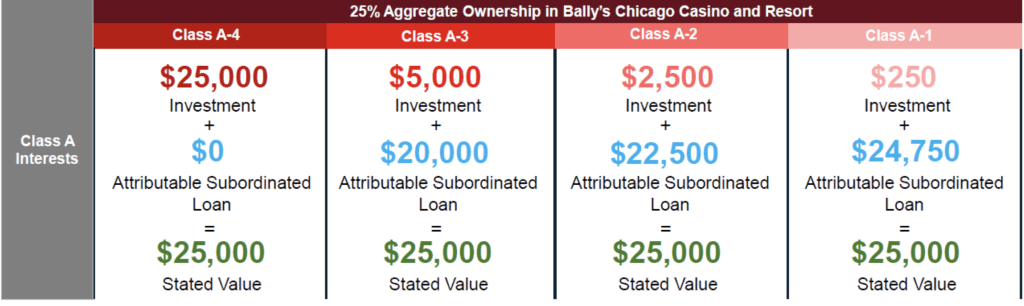

Bally’s Casino is offering 10,000 Class A shares, which grant investors partial ownership in Bally’s Chicago. Collectively, these investors will own 25 percent of the casino, according to documents filed with the SEC.

The investment offer is open to Illinois, New York, Texas and Florida residents, with preference given to residents of Chicago and Illinois.

There are four investment tiers available. Each share is valued at $25,000, with a mix of lower-cost shares available, according to investment documents.

Here’s the breakdown:

- 500 shares are available for $250 each

- 1,000 shares are available for $2,500 each

- 1,000 shares are available for $5,000 each

- 7,500 shares are available for $25,000 each

Bally’s will fund the difference between the $25,000 share value and the investor’s chosen buy-in price through a financial instrument called an “attributable subordinated loan.” The loan will be funded through the nearly $195 million Bally’s intends to raise from investors, and it is technically debt that carries an 11 percent interest rate. The loan would be paid off through Bally’s future profits.

Anyone who purchases a share with a loan attached will need to wait until that debt is paid off by Bally’s. People who invest the full value of a share can start to receive dividends when the casino is profitable.

Bally’s has estimated it will take three to five years after opening the permanent casino to become profitable, according to investment documents.

The gaming company in 2023 opened a temporary Bally’s in the historical Medinah Temple in River North. Its permanent facility, on the site of the former Chicago Tribune printing plant, is slated to include a 500-room hotel tower, a theater, an exhibition hall, casino and 11 restaurants.

Listen to the Block Club Chicago podcast:

Listen to the Block Club Chicago podcast: