Bank of America is urging investors to “sell-the-rip” in U.S. stocks as the worst is likely still to come for markets this year.

Stay Ahead of the Market:

Analyst Michael Hartnett says despite the rally in U.S. equities seen over the past few days, the market remains extremely sensitive and is likely to move lower in coming months as the full impact of President Donald Trump’s trade tariffs on companies and the American economy becomes clear.

Hartnett adds that a weak American consumer, many of whom are seeing their wealth hurt by volatile stock markets, is a key reason why investors should not be tempted to buy equity dips right now. Bank of America estimates that stock losses this year have wiped out $6 trillion from household wealth.

Market Conditions

The analyst says investors would be smart to wait until important conditions are met before wading back into the stock market. Specifically, Hartnett says investors should watch for signs of “resilient consumer spending, perhaps driven by a tight labor market.”

Another condition that Bank of America wants to see met before investors begin buying stocks again is a sign that the U.S. Federal Reserve is ready to step in with interest rate cuts. Currently, futures traders are forecasting a 65% chance that the central bank cuts rates by 25-basis points in June of this year.

Lastly, Hartnett says investors should steer clear of stocks until a “peace deal” over trade is reached between President Trump and President Xi Jinping of China. At a minimum, America’s current 145% tariffs on Chinese imports should be lowered to well below 60% before investors move off the sidelines. For now, Hartnett urges investors to buy bonds and gold.

Is BAC Stock a Buy?

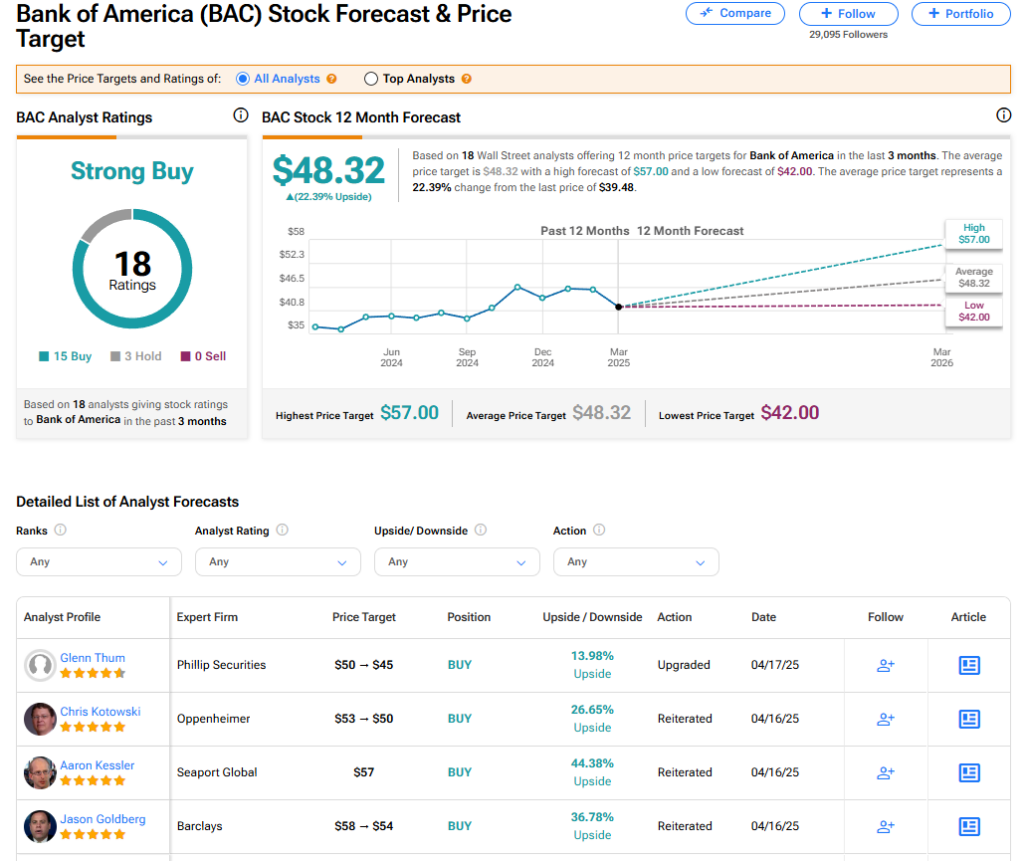

The stock of Bank of America has a consensus Strong Buy rating among 18 Wall Street analysts. That rating is based on 15 Buy and three Hold recommendations assigned in the last three months. The average BAC price target of $48.32 implies 22% upside from current levels.

Source link