Bitcoin and crypto prices have swung wildly since U.S. president Donald Trump entered the White House in January—priming traders for an “apocalyptic scenario.”

The bitcoin price has topped $90,000 per bitcoin this week after falling to April lows of under $75,000 with some bullish traders predicting the “tide may have turned” on Wall Street.

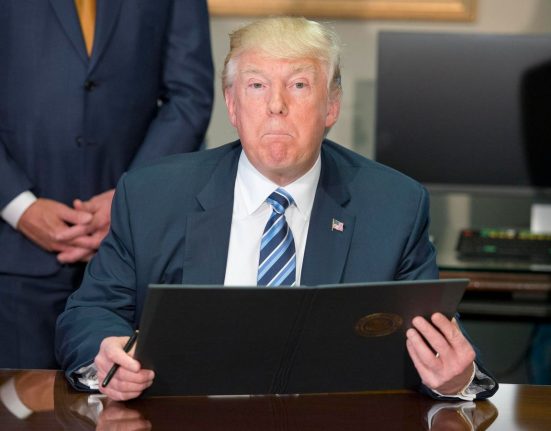

Now, as the U.S. teeters on the verge of a U.S. dollar “confidence crisis,” a leak as revealed growing fears that Trump’s plans for bitcoin and crypto could spark “contagion” that risks blowing up the financial system.

Sign up now for the free CryptoCodex—A daily five-minute newsletter for traders, investors and the crypto-curious that will get you up to date and keep you ahead of the bitcoin and crypto market bull run

US president Donald Trump’s plans for bitcoin and crypto have sparked panic in Europe, as fears … More

The European Central Bank (ECB) and the European Commission have clashed over the effectiveness of the trading bloc’s landmark Markets in Crypto Asset Regulation (MiCA) following U.S. president Donald Trump’s embrace of bitcoin, crypto and specifically U.S. dollar-based stablecoins.

The ECB is calling for an “urgent” rewrite of the law, which was fully adopted only at the end of last year.

The ECB, under president Christine Lagarde, has warned Trump’s stoking of the stablecoin market risks sparking financial “contagion” that could blow up the European economy, according to a leaked policy paper seen by Politico.

In recent months, two crypto bills that would cement stablecoins’ place in the financial system have been making their way through Congress, with Trump’s executive director of the president’s council of advisers on digital assets, Bo Hines, predicting the legislation could reach Trump’s desk by August.

The predicted growth of the stablecoin industry in the coming years, currently led by Tether and its USDT dollar-pegged stablecoin but facing competition from both Wall Street and Silicon Valley, has triggered “panicked” warnings from Lagarde and the EBC’s digital payments czar Piero Cipollone.

This week, research by Standard Chartered Bank found the stablecoin market could grow to $2 trillion by the end of 2028 from $230 billion currently thanks to passage of pro-crypto U.S. legislation.

Lagarde has warned the MiCA rules will fail to prevent dollar-denominated stablecoins from flooding Europe, which could result in an exodus of European savings into the U.S. as people opt to move their cash into USDT, Circle’s USDC and burgeoning rivals.

“On Thursday, Lagarde said MiCA would have to change, and implied that the unique threat posed by stablecoins was ‘understood’ by the Commission and other EU institutions,” Politico reported.

The European Commission hit back, accusing the ECB of being melodramatic. “The risks arising from such global stablecoins seem to be overstated and are manageable under the existing legal framework,” the Commission said in a paper seen by Politico.

An anonymous European Commission official also claimed the ECB may be drumming up the risk of U.S. dollar stablecoins to boost support for the controversial digital euro project, effectively a government-backed euro-based stablecoin.

Sign up now for CryptoCodex—A free, daily newsletter for the crypto-curious

The bitcoin price has surged since U.S. president Donald Trump’s election victory last year.

For now, the bitcoin price and broader crypto market have dropped back from their recent highs but have held up better than some high risk tech stocks.

“Bitcoin has been surprisingly resilient throughout the trade war, holding up against altcoins and, more recently, against the S&P 500,” Alex Svanevik, the chief executive of bitcoin and crypto analytics platform Nansen, said in emailed comments. “The ongoing positive news flows around bitcoin, notably the Treasury looking for ways to swap reserves into bitcoin, have likely helped.”

“That said, bitcoin remains a risky asset that would be vulnerable if the odds of recession increase,” Svanevik said, pointing to data that shows the chance of the U.S. falling into recession is around 50%, according to risk asset pricing.

“We expect gold to be more resilient although gold holdings could be net sold in case investors panic and want to cover margin call. This was seen one to two days at the worst of the trade war earlier this month.”