Priority sector refers to sectors that have a significant impact on large sections of the population, the weaker sections, and labour-intensive industries

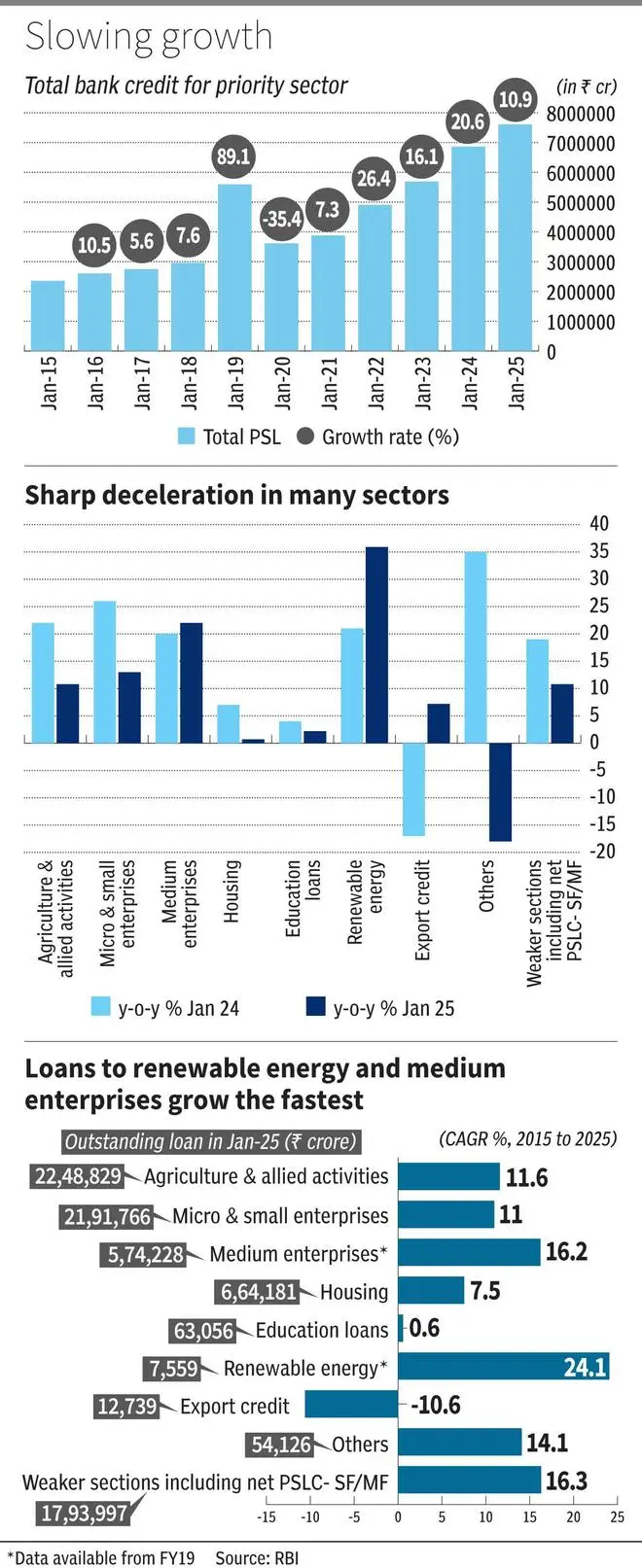

As the overall credit growth in the economy skids due to regulatory tightening and high interest rates, priority sector loans are also witnessing a slowdown. Total lending to the priority sector stood at ₹76.1 lakh crore as of January 2025 compared with ₹68.8 lakh crore in January 2024.

The year-on-year (y-o-y) growth registered in these loans was 10.87 per cent in January 2025. This is half of the y-o-y growth in January 2024 at 20.55 per cent. This is a sharp moderation compared to the y-o-y growth of 26.42 per cent and 16.07 per cent recorded in January 2022 and January 2021 respectively. It is also the first time since FY21 that PSL growth has dropped below 11 per cent.

According to the RBI, priority sector refers to sectors that have a significant impact on large sections of the population, the weaker sections, and labour-intensive industries. The RBI mandates scheduled commercial banks to allocate a certain percentage of their credit to these sectors, as they are likely to be overlooked by traditional lending practices. Priority sectors include agriculture, MSME, education, housing, social infrastructure, renewable energy, and others.

“The recent deceleration in PSL credit growth can be attributed to elevated interest rates in interest rate-sensitive segments within the priority sector. Moreover, banks and NBFCs have adopted a more cautious lending approach in FY25, reflecting heightened concerns around asset quality, particularly within the MSME and small borrower segments. This has led to stricter credit appraisal standards and more conservative lending practices,” says Harshvardhan Bisht, Partner, Financial Services Consulting, EY India.

Housing and social infrastructure hit

The sectors which witness the highest lending in the priority sector lending are agriculture, Micro and Small industries and Medium enterprises. Outstanding loans in these segments stood at ₹22.5 lakh crore, ₹21.91 lakh crore and ₹5.7 lakh crore, respectively, as of January 2025.

While y-o-y growth was hit across all sectors, lending to medium enterprises displayed resilience, recording 22 per cent y-o-y growth in January 2025. Loans to the renewable energy sector too witnessed a steep increase of 35.9 per cent in the same period.

Housing loans, however, registered a sharp deceleration, falling from 7 per cent growth to just 0.7 per cent, raising questions about the momentum of government schemes like Pradhan Mantri Awas Yojana (PMAY). According to Bisht, higher interest rates, and constraints like limited availability of affordable housing have played a role in restraining the flow of credit in the housing sector.

Loans to the social infrastructure sector too slowed sharply from 3 per cent in January 2024 to -61.9 per cent in January 2025.

Long-term trend

Despite the short-term dip, the long-term growth in PSL appears to be quite stable. The compounded annual growth rate (CAGR) of both agriculture and MSEs in the past decade has been steady ranging between 10 to 12 per cent.

On the other hand, renewable energy and medium enterprises have shown robust growth over the past five years. The data presented by RBI reveals that loans to the renewable energy sector recorded the highest compounded annual growth rate (CAGR) of 24.06 per cent in the last five years. Medium enterprises followed closely with a CAGR of 16.23 per cent, reflecting increased credit support to expanding businesses. “This shift is driven by policy tailwinds, technological innovations and evolving credit risk dynamics… As asset quality issues persist in traditional PSL sectors, banks are pivoting towards sectors offering more favourable risk-adjusted returns, making renewable energy and medium enterprises key focus areas in PSL portfolios,” Bisht added.

Recent revision of the PSL guidelines, effective from April 2025, which enforce more inclusive lending with its emphasis on housing, education loans and equitable access to finance to weaker sections is expected to help the growth in this sector going forward

Published on April 21, 2025