David Sacks, a renowned venture capitalist and early PayPal executive, has officially joined the White House job as the Crypto and AI Czar. Interestingly, he made headlines just before joining for selling $200M worth of crypto holdings, including Bitcoin. While he believes it is a strategic exit considering his role, others question whether he will regret it later, as Bitcoin looms into the full cycle, where experts anticipate a price rally (cycle top) to $440k.

David Sacks News: $200M Crypto Sold Before Joining White House Role

David Sacks officially joined the White House’s AI and Crypto Czar role, appointed by U.S. President Donald Trump. Interestingly, before joining the Trump administration, he sold over $200M in digital assets, including Bitcoin. The detailed 11-page White House Memo reveals that Sacks has sold at least $85M from his personal holdings and the remaining from his firm, Craft Ventures.

Although this was a significant sell-off, a source reveals that it was only 1% of the venture capitalist’s assets. Additionally, he still holds a small fraction of digital assets but plans to sell them as well. However, it is debatable, as several cabinet members, including Commerce Secretary Howard Lutnick, D.O.G.E. Elon Musk, and even Donald Trump have crypto investments, resulting in investors questioning any additional motive.

Besides, the community questions the timing of the $200M sale, as analysts predict Bitcoin price rally to $440k.

Bitcoin Price Rally: Crypto Analyst Predicts $440K Cycle Top

Crypto analysts have been quite optimistic about the Bitcoin price trajectory for years. However, the recent downturn amid the market’s bearish sentiments, David Sack’s sell-off news, and the crypto market crash caused investors to worry about this digital asset’s future.

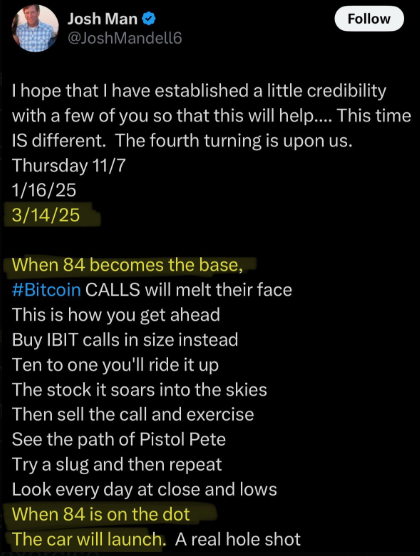

However, things align to change, as BTC’s price overcame the $84k barrier and is moving upward. Adding to the enthusiasm. Crypto analyst Josh Mandel has predicted BTC’s next milestone after his previous one came true.

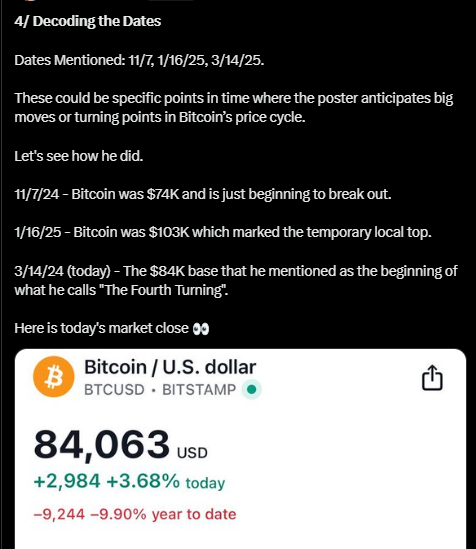

In a few-month-old post, he forecasted this digital asset to hit $84k on March 14, 2025, and that’s what happened.

Not only that, the other mentioned dates also had the proper mention of big moves or turning points, shocking everyone with the accuracy of the forecast.

Now, the eyes are on the next hint, built on the ‘Fourth Turning’ concept- a historical cycle theory suggesting drastic societal and economic shifts. In a poem, Josh Man says:

When 84 becomes the base, Bitcoin CALLS will melt their face. This is how you get ahead of Buy IBIT calls in size. Instead of ten to one, you’ll write it up.

The analyst Peter Duan, who decoded it, claims that the poem suggests $444k is the ultimate Bitcoin cycle top. This shot a new enthusiasm among investors, especially as a lot is happening around this asset, including the Bitcoin Reserve Executive Order signing.

The global adoption is also at its peak; as Godman Sachs mentioned BTC & crypto for the first time in its annual shareholder letter, and a Minnesota senator introduced a bill to accept BTC payments.

Did David Sacks Sell Too Early?

Josh’s Bitcoin price prediction is just an anticipation, and the market’s unpredictability may change the direction. However, simultaneously, the accuracy of his predictions made people question whether David Sacks made the right decision.

Sacks probably made this decision due to a conflict of interest. Many critics, including Senator Elizabeth Warren, have objected to Sack’s Crypto Czar role with high crypto holdings, but that’s no longer a discussion.

In the All-In podcast, Savid revealed that he did it “because I didn’t want to even have the appearance of a conflict,” said CNBC.

Interestingly, there have been incidents where people sold their holdings at a low amid circumstances but regretted it. Now, it is time to see how things will take a turn, as analysts anticipate the BTC price will reach $440k.

Final Thoughts: David Sacks & Bitcoin Price Trajectory in Doubt

Predicting Bitcoin’s exact price trajectory accurately is nearly impossible. However, analyzing historical trends, institutional demand, upcoming developments, and speculative enthusiasm could determine an ideal result. Crypto analyst Josh Man succeeded in his predictions, and now the eyes are on his $440k BTC target. David Sacks’s $200M sale would become a missed opportunity if this happened. However, a different result would make his crypto exits worth it.

Frequently Asked Questions (FAQs)

David Sacks is a venture capitalist and earlyer PayPal executive who joined the White House as an AI and crypto czar.

Sacks sold his crypto holdings due to the critics’ claims of a conflict of interest in his new role with his digital asset holdings.

Josh Man’s post hints towards Bitcoin’s price rising to $440k, making $84k as the base. Analysts anticipated that his prediction might come true due to previous accurate predictions.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

✓ Share: