If you’re a Massachusetts property owner and pay somewhere around $7,000 or $8,000 for your tax bill, you can consider yourself among those who pay the state’s average.

But for some property owners, the average $7,732 bill may seem pretty steep — with the lowest average single-family tax bill standing at less than $2,000 in a handful of Western Massachusetts towns.

On the other hand, communities like Lincoln, Brookline and Weston pay substantially more with an average single-family tax bill costing taxpayers more than $20,000 for a single-family home, according to Massachusetts Division of Local Services data.

“Property tax is an assessment on the ownership of real and personal property,“ according to the Division of Local Services of the state’s Department of Revenue.

“An owner’s property tax is based on the assessment, which is the full and fair cash value of the property.”

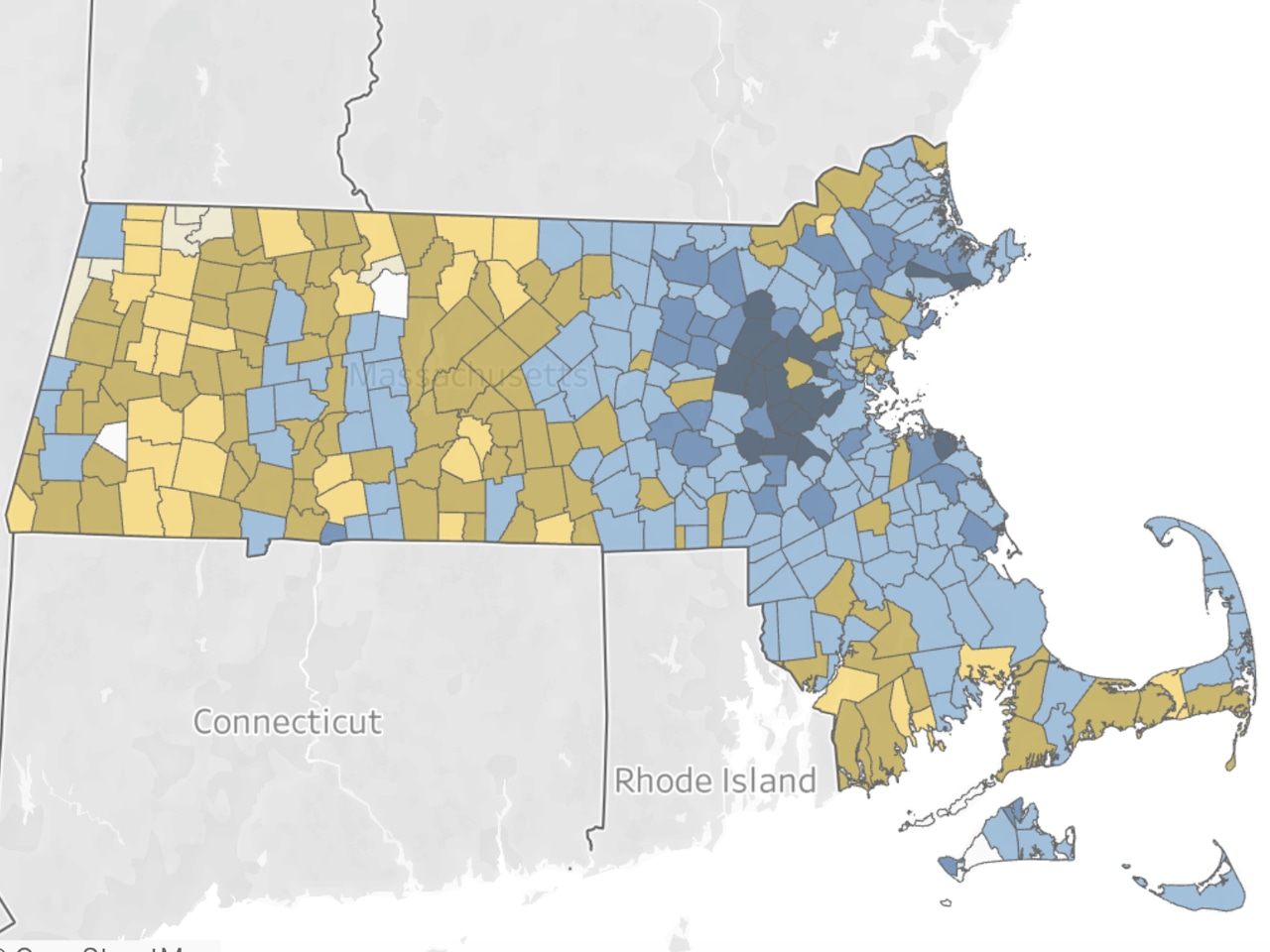

A map, embedded below and also available at this link, show’s the breakdown of every city and town in Massachusetts and what their average single-family tax bill is in 2025.

Assessors in every community in the Commonwealth assess all property at its “full and fair cash value.”

According to the Division of Local Services, “property taxes are the largest funding source for teachers, police, firefighters, public works and many other local resources and services” for the communities.

As of every Jan. 1, assessors determine property as either a residential, open space, commercial or industrial property.

The lowest average single-family tax bill in the Bay State is in Hancock with a bill of $1,027 based on 2025 property tax data.

The highest is Weston with an average tag of $25,464.

“Property values continue to rise in Massachusetts,” the Office of Secretary of the Commonwealth of Massachusetts said in a statement. “You may find your tax bill on the rise as well.”

In 2023, the average property tax bill for a single-family home was $7,059, according to the Secretary of the Commonwealth’s Office.

In 2024, the average property tax bill was $7,405 — representing a near 5% increase, data shows.

This year, the average increased yet again — topping $7,700 — representing an increase of roughly 10% in just two years.

The Secretary of Commonwealth’s Office encourages residents who have questions about their bills and assessments to do their research.

“If your city or town lists property assessment information on their website, compare your property with other similar properties,” the Office advised.

“Look for any potential errors in assessing your home’s value.”

Top 10 municipalities with the highest and lowest average single-family tax bills in 2025

Highest

- Weston: $25,464

- Brookline: $24,729

- Lincoln: $20,462

- Wellesley: $19,792

- Concord: $19,585

- Sherborn: $19,483

- Lexington: $19,306

- Belmont: $18,775

- Dover: $18,563

- Wayland: $17,854

Lowest

- Hancock: $1,027

- Rowe: $1,468

- Monroe: $1,587

- Florida: $1,767

- Erving: $2,526

- New Ashford: $2,722

- Tolland: $3,003

- Windsor: $3,100

- Royalston: $3,158

- Clarksburg: $3,195