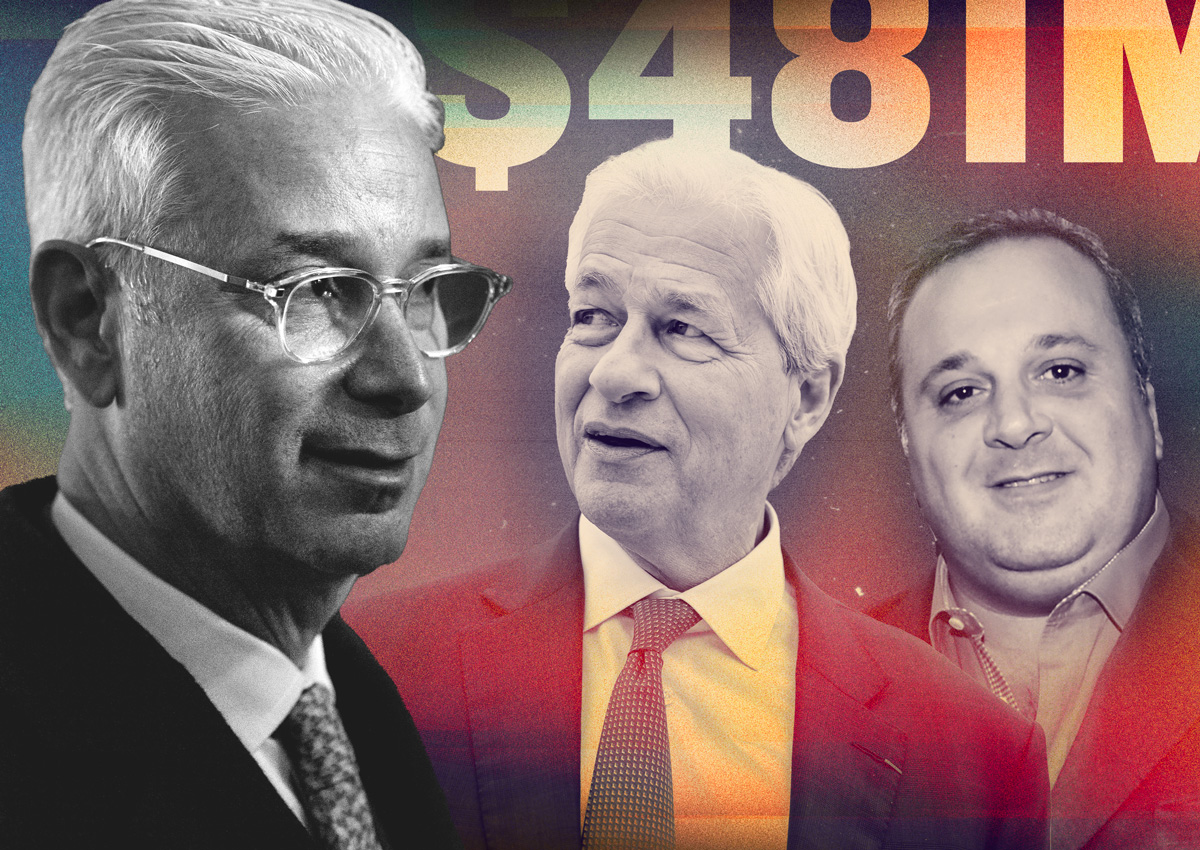

New allegations tied to a mortgage fraud scandal that rocked the industry and landed an executive in federal prison now implicate JPMorgan, the lender on the deal, and the borrower — New York’s Chetrit Group.

Wells Fargo, which filed suit in federal civil court as trustee on a $481 million CMBS loan, alleges JPMorgan knew the mortgage it made to Chetrit for a national multifamily portfolio was based on inflated financials. But it doled out the debt anyway.

The suit — first reported by Reuters — also alleges that the Chetrit Group was aware that the numbers had been fudged by the seller Roco Real Estate.

Roco and the 43-property deal have been central to a widening federal investigation into mortgage fraud. In 2023, Roco principal Tyler Ross pleaded guilty to one count of conspiring to commit an offense against the United States related to a previous financing of the properties. He was sentenced to a year in federal prison in September.

The Department of Justice and the Federal Housing Finance Agency have uncovered that in multiple deals, operators routinely manipulated property financials such as expenses to obtain larger loans from lenders than they would have otherwise secured.

So far, at least six real estate operators across the U.S. have pleaded guilty. The investigation is ongoing.

Wells Fargo’s filing marks the first major lawsuit against a lender in the broader commercial mortgage fraud scandal. Lenders have largely claimed to be victims of borrowers’ fraud.

JPMorgan declined to comment on the lawsuit, as did an attorney for Wells Fargo.

Chetrit, through a spokesperson, pointed the finger at Roco, calling itself “a victim of seller fraud, which was investigated by the U.S. Department of Justice.”

“Financial misrepresentations were made by the seller that we unknowingly relied upon when we purchased the property,” said a Chetrit representative in a statement.

“We suffered great financial loss due to the seller’s fraud,” the spokesperson said. “As a result of the fraud, the seller was convicted.”

The saga dates back to 2019 when Chetrit was shopping for debt to buy Roco’s apartment deal. Through due diligence, it allegedly found Roco had falsified trailing 12 month financial statements, notably inflating net operating income by 25 percent.

Chetrit found $3.5 million in reported income did not exist and $2.6 million in repair costs and expenses were missing, according to the lawsuit. It allegedly flagged the errors to Roco and the seller fessed up to the flubs, agreeing to slash the sale price by over $65 million.

The Chetrits then brought the fraudulent financials to JPMorgan’s attention.

Internally, the lender acknowledged the reporting was unreliable, according to the complaint. An analyst handling due diligence on the deal texted a colleague that the financial statements were “‘made up’” and “‘ridic[ulous],’” the suit details.

Ultimately, the 10,000-unit portfolio traded for $522 million, the suit states. The deal was risky — a $481 million loan on a $522 million acquisition shakes out to an incredible 92 percent loan-to-value ratio. But JPMorgan knew it would insulate itself from problems by immediately securitizing the deal, and pocket millions of dollars in fees to boot, according to the lawsuit.

JPMorgan “was willing to issue such a risky loan because it never intended to hold it,” the suit said. Rather, the risk would be passed on to the deal’s unwitting bondholders, who now face tens of millions of dollars in losses, the suit alleges.

Wells Fargo argues JPMorgan “had an obligation” to validate whether the figures were accurate.

Chetrit defaulted on the debt in 2022 after the deals failed to generate sufficient cash flow to service the loan. In early 2023, a spokesperson for the firm said it was looking to sell assets to right the ship.

The firm nabbed a temporary forbearance agreement in June 2023 but defaulted on the terms just a few months later, according to Morningstar Credit. A receiver was appointed in February 2024 and the past year has seen a spate of foreclosures: four Texas properties, three in Alabama, seven in Mississippi, according to Morningstar.

Pre-foreclosure filings in Florida, Ohio, Arkansas and Louisiana are pending, as of last month.

Meanwhile, the Wells Fargo suit seeks to hold Meyer Chetrit, the guarantor on the debt, personally liable for the potential tens of millions in losses to the trust.

The trustee demands JPMorgan either repurchase the loan or pay damages to cover the trust’s losses.

Read more

Chetrit making progress on pesky $481M loan

Fannie Mae says it suffered losses from commercial mortgage fraud

Real estate executive pleads guilty to multi-year conspiracy to falsify financial statements