As of 2023, 37% of Americans would not have enough savings to cover a $400 expense using cash, according to data from the Federal Reserve. That’s well below the minimum amount of money most people need on hand for emergency fund purposes.

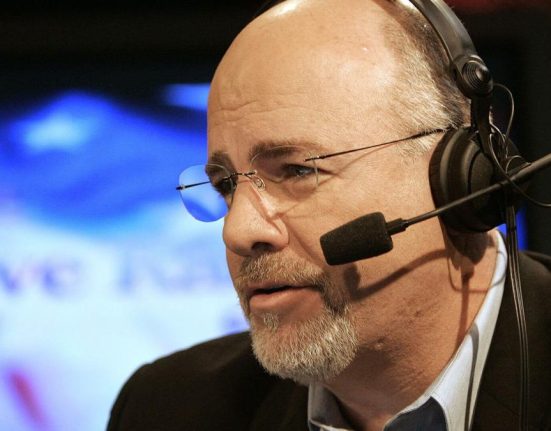

Many financial experts, including Dave Ramsey, recommend having enough emergency savings to cover three to six months of essential bills. If you were to lose your job, it could take that long to find another. Having savings to tap allows you to avoid debt — and costly interest — during that period.

Don’t miss

-

Commercial real estate has beaten the stock market for 25 years — but only the super rich could buy in. Here’s how even ordinary investors can become the landlord of Walmart, Whole Foods or Kroger

-

Car insurance premiums in America are through the roof — and only getting worse. But 5 minutes could have you paying as little as $29/month

-

These 5 magic money moves will boost you up America’s net worth ladder in 2024 — and you can complete each step within minutes. Here’s how

Of course, if you were to ask some financial experts, they might say that a three- to six-month emergency fund isn’t even enough. Suze Orman, for example, changed her tune on emergency savings in the wake of the pandemic and now recommends an emergency fund that can cover up to 12 months of essential living costs.

But what if you were to decide that you don’t need an emergency fund at all? That’s what one financial writer did after depleting her savings a few years back. But she’s not stressed about her lack of emergency cash. Here’s why.

When you have a different backup plan

Business Insider recently published a story about a financial writer named Holly who depleted her emergency savings a few years ago and has not made any effort to replenish. Her logic for this stems from a few places.

First, she claims she has a great credit score, which gives her easy access to borrowing. Experian reports that the average American had a credit score of 715 as of 2023, which is considered “good.” An above-average credit score could mean easier approval for credit cards or lines of credit with generous spending limits.

Holly also has investments outside of retirement accounts she can tap in a pinch. IRA or 401(k) plan withdrawals taken before turning 59 ½ are generally subject to a 10% penalty. But investing in a taxable brokerage account allows you to remove funds penalty-free at any time.

Holly also says she and her husband own several businesses. Having multiple income streams gives her the confidence that she won’t be in a position where she has to replace her paycheck entirely.

Read more: Car insurance rates have spiked in the US to a stunning $2,150/year — but you can be smarter than that. Here’s how you can save yourself as much as $820 annually in minutes (it’s 100% free)

The flaw in the plan

While Holly makes a good case for not having an emergency fund, there are a few problems with her approach. First, a great credit score might open the door to plenty of borrowing opportunities. But at the end of the day, you’re still borrowing money and racking up some amount of interest in the process. You also risk damaging your credit if you fall behind on your debt payments.

Also, the reason savers are advised to keep their emergency funds in the bank and not an investment account is that with the latter, the value of your assets can change over time. If you’re forced to sell off stocks at a time when the market is down, you could lock in a permanent loss on those stocks. This assumes, of course, that you have investments, which not everyone does.

Finally, having multiple income streams is a smart way to protect yourself financially. But this assumes that you’re able to work. Unless you have a lot of money in true passive income, like generous stock dividends or interest payments from a bond portfolio, your ability to earn an income generally hinges on you being available to do what it is you do – even if that’s multiple things.

For example, if you’re an IT professional who designs websites on the side for extra cash, a broken hand might sideline you in both situations. The same holds true if you moonlight as a food delivery person or dog-walker.

That’s why it’s generally a smart idea to have some emergency cash in the bank. If saving three months’ worth of expenses isn’t in the cards right now, use one month as a starting point. Don’t leave yourself vulnerable to unexpected financial events when they could happen at any time.

What to read next

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.