Marco_Bonfanti

Dear readers,

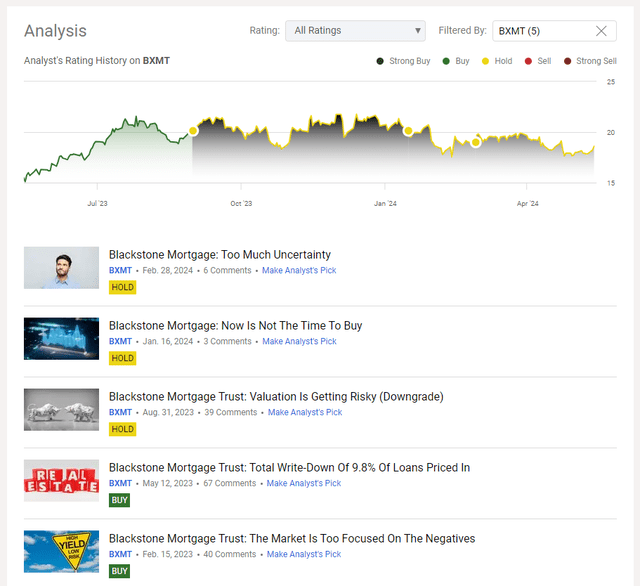

Blackstone Mortgage Trust (NYSE:BXMT) is one of the biggest and most well-knows mortgage REITs (mREITs) out-there. It is a stock which I’ve covered multiple times here on Seeking Alpha, most recently in February in an article called Too Much Uncertainty.

I was relatively bullish on the stock in the first half of 2023 and issued a couple of BUY calls, which have done OK. Over time, however, I have grown increasingly bearish and downgraded the stock to a HOLD due to (1) a generally poor long-term track-record of mREITs, and (2) specifically to BXMT, concerns about a potential wave of office loan defaults that could threaten dividend coverage and valuation.

SA

Since I last covered the stock, the stock price has fallen by almost 5% from $19.60 to $18.60 per share, while the S&P 500 (SPX) has climbed marginally higher by about 3.5%. More importantly, the company has reported their Q1 2024 results, which were quite poor and confirmed some of my doubts regarding the quality of BXMT’s office loans.

Q1 2024 results

To say it bluntly, first quarter results were pretty bad.

The stock failed to post any sort of top-line growth as income from loans declined by 18% year-over-year and adjusted distributable earnings (prior to charge-offs) were down 5% last quarter alone. To make things worse, Q1 marked the first quarter with loan charge-offs as $61 Million in office loan principal was written down as these loans were deemed non-recoverable.

As a result, unadjusted distributable earnings declined by 50% last quarter to only $0.33 per share, well short of the $0.62 per share dividend. Note that without the charge-offs, the dividend would have been covered with $0.65 per share in adjusted distributable earning, but barely. Future charge-offs, or the lack of, will determine whether the high dividend is covered in the future. But honestly, things are not looking well here.

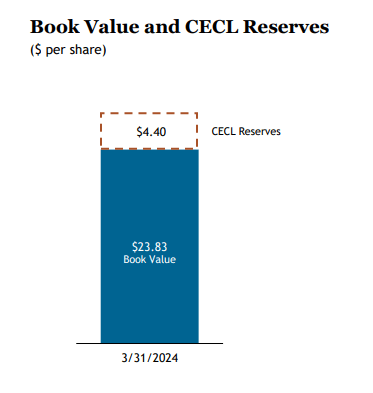

Last quarter, the company once again made significant additions to its CECL reserve, anticipating more trouble for their office portfolio. In particular, it added $234 Million to the reserve related to seven newly impaired loans. Currently, the reserve totals $766 Million ($4.40 per share) which covers 25% of the outstanding amount of the riskiest 5-rated loans.

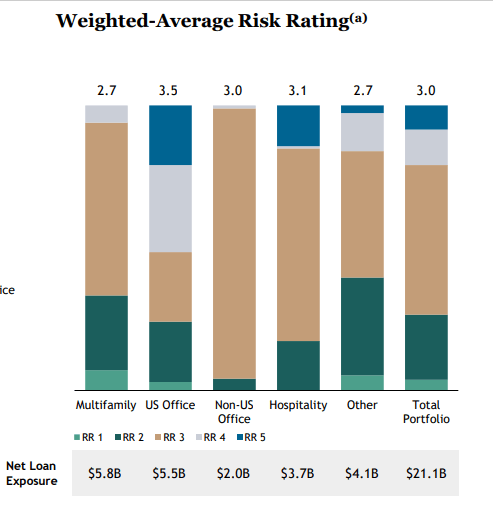

I think it is quite likely that we will continue to see the CECL reserve climb higher in Q2 and Q3 of this year, and further charge-offs are a distinct possibility here, especially when we consider that the percentage of performing loans has reached a low of 92% and the average risk rating of office loans remains elevated at 3.5.

BXMT IR

Risks beyond loan defaults

By now, most investors understand that loan defaults, especially for office, are the biggest risk to BXMT’s dividend coverage and valuation. But there is an additional factor to consider, which makes the situation even worse.

I covered some mortgage REIT basics in my article called Valuation Is Getting Risky (Downgrade). The point I was trying to make was that because mREITs typically have close to 100% of floating-rate debt, when interest rates rise, the initial impact is an increase in earnings which makes it seem that everything is going well. It’s only when the increased interest payment catches up with borrowers – leading to loan defaults (often with a significant lag) – that the full effect of higher rates is felt by mREITs.

This logic can also be extended to declining rates, which is where the risk lies for BXMT. I recently showed, in an article called VNQ: A Bet On Rates I Am Willing To Make, why interest rates are likely to decline more than expected later this year. If I’m right and rates do head lower, then BXMT will find itself in a tough spot. The interest payments it receives from borrowers will decline over-night, and while this will likely ease pressure on borrowers, it may be too late for some loans which may eventually prove non-recoverable.

Is BXMT a HOLD or a SELL?

The path that the stock takes will depend almost entirely on whether it experiences more defaults in the coming quarters. Today, the stock pays a very high 13% dividend yield, but I advise caution here. There is a chance that the dividend will remain covered, but this assumes (1) no additional charge-offs and (2) that earnings are maintained at today’s level even in a lower rate environment. Both seem unlikely at the moment.

In addition to the dividend, most analysts that have a BUY rating on the stock, point to a large discount to book value which, in their opinion, justifies the stock as being undervalued. Currently, the book value (net of the CECL reserve) stands at $23.80 per share, which corresponds to a P/BV of 78%.

BXMT IR

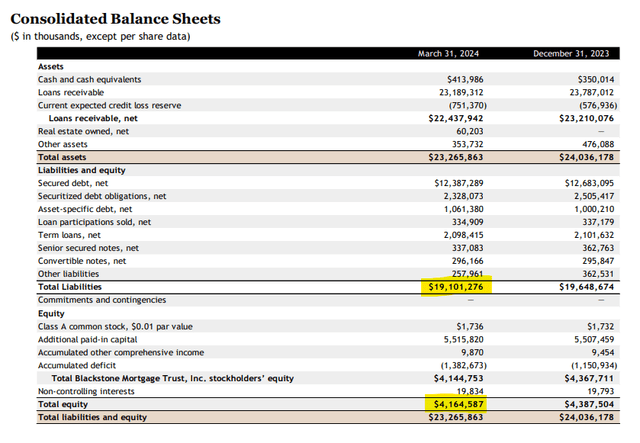

This gives an illusion of a large margin of safety. I say an illusion because BXMT’s leverage makes the price very sensitive to changes in book value. With $19 Billion in liabilities and only $4 Billion in equity, BXMT operates with a 5.75x leverage, which means that a 1% decline in book value results in a 5.75% decline in equity (and stock price).

BXMT IR

Therefore, the 22% discount to book value really only corresponds to a 3.8% margin of safety (=22%/5.75). In other words, the market is currently pricing in default of 3.8% of the portfolio, exceeding what is already in the CECL reserve.

Personally, I don’t see that as a large enough margin of safety to call the stock anywhere near undervalued. At the same time, despite a barely covered dividend at best and a non-negligible probability of more charge-offs in coming quarters, I don’t think the stock deserves a SELL either. Therefore, I reiterate my HOLD rating here at $18.60 per share.